Bitcoin long-term holders dominate profit realizations in 2024, leveraging price peaks

Bitcoin long-term holders dominate profit realizations in 2024, leveraging price peaks Quick Take

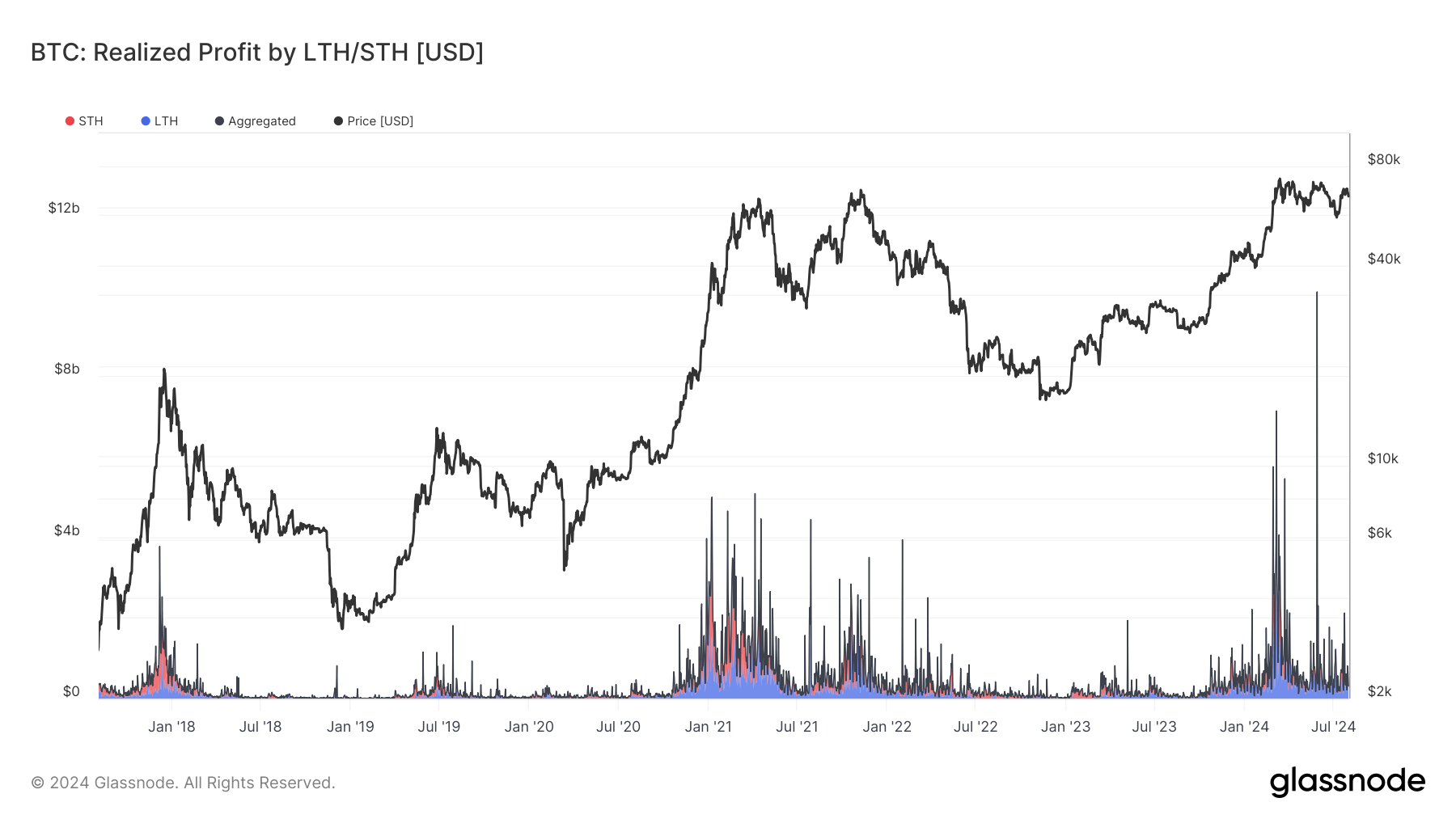

DEFINITION: Realized Profit is a metric that quantifies the total profit of a digital asset, calculated by the difference between the sale price and the acquisition price for all spent coins where the sale price was higher than the acquisition price. The Realized Profit by LTH/STH (Long-Term Holders/Short-Term Holders) metric further enhances this by categorizing digital assets into two cohorts based on the duration of holding.

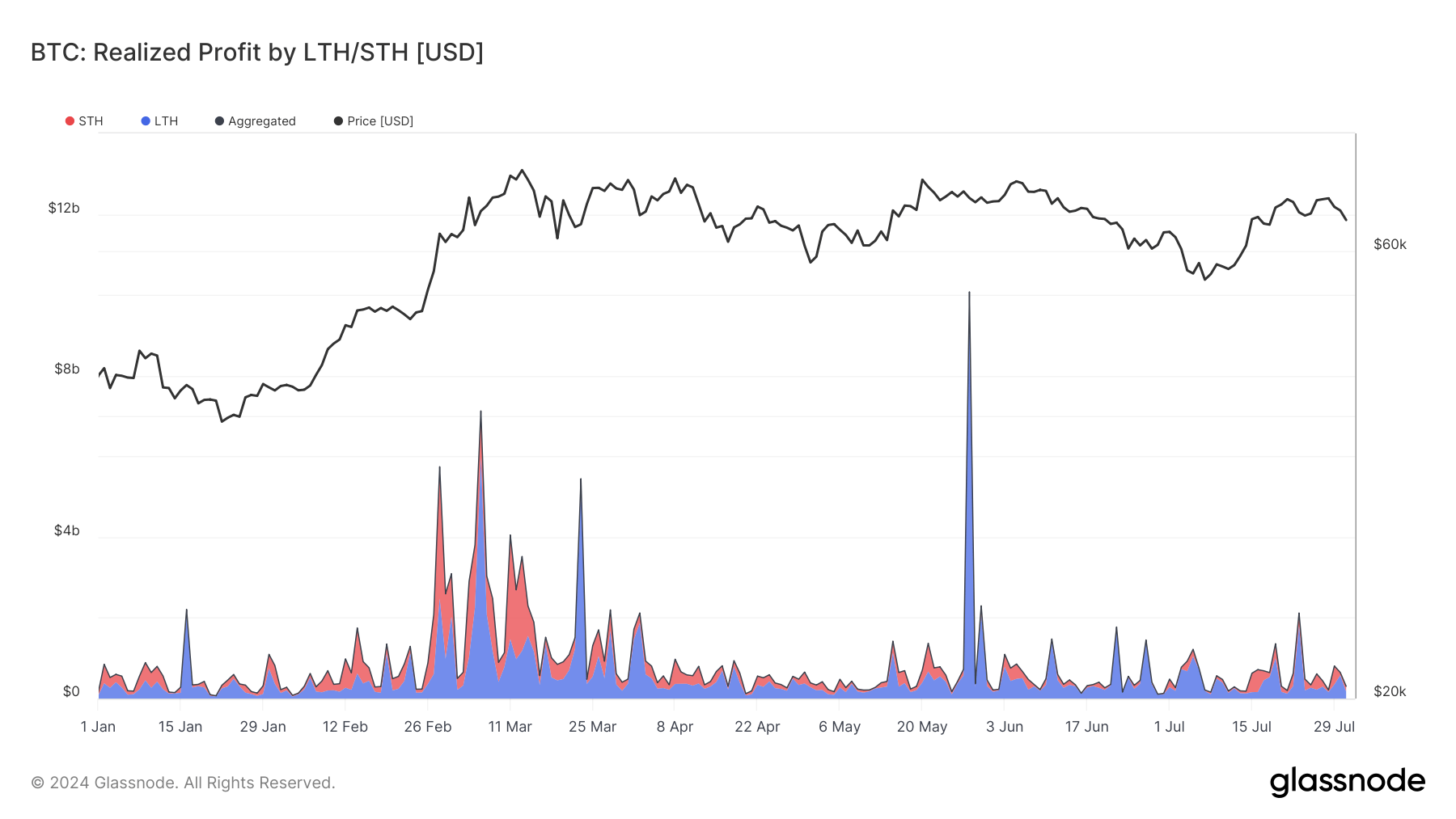

Bitcoin’s realized profit by long-term holders (LTH) and short-term holders (STH) demonstrated significant variation throughout 2024. The chart illustrates periods of heightened profit realization, particularly from LTH, as marked by notable peaks in blue.

Early in the year, a substantial spike in realized profits occurred around late February to early March, coinciding with Bitcoin’s all-time high. This activity suggests a notable profit-taking event among both LTH and STH, reflecting market sentiment and profit optimization strategies.

As the year progressed, realized profits continued to show intermittent spikes, with another significant peak in late May. This corresponds with Bitcoin’s value reaching around $70,000, indicating another phase where holders capitalized on price increases. LTH’s sustained activity throughout these periods highlights their strategic exits during bullish trends.

The data also points to a build-up of realized profits in July, aligning with Bitcoin, which was nearly $70,000 once again. This suggests a continued pattern of LTH leveraging price highs for profit realization. Comparatively, STH profit realizations, represented in red, were more sporadic and less pronounced, indicating a lower frequency of profit-taking by this cohort.

Overall, the patterns observed throughout 2024 underline the strategic behavior of LTH in capitalizing on market rallies, while STH showed more cautious profit-taking behavior.

CoinGlass

CoinGlass

Farside Investors

Farside Investors