Keep an eye on Bitcoin with these top five portfolio apps

Keep an eye on Bitcoin with these top five portfolio apps Keep an eye on Bitcoin with these top five portfolio apps

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Coin tracking apps are fantastic tools for keeping track of the cryptocurrency market, but knowing which one to trust can be difficult. Below are CryptoSlate’s recommendations for the top five portfolio trackers.

Staying on top of the movement of more than 2,000 cryptocurrencies would be virtually impossible without the help of crypto price trackers. These apps play a vital role in the crypto market, as they allow traders and investors to monitor and analyze digital assets in real time.

However, booming interest in the crypto market has led to the creation of hundreds of websites offering coin and portfolio tracking services. Since there isn’t a central body that would regulate these websites, the data they show is often vastly different and often doesn’t reflect the real state of the market.

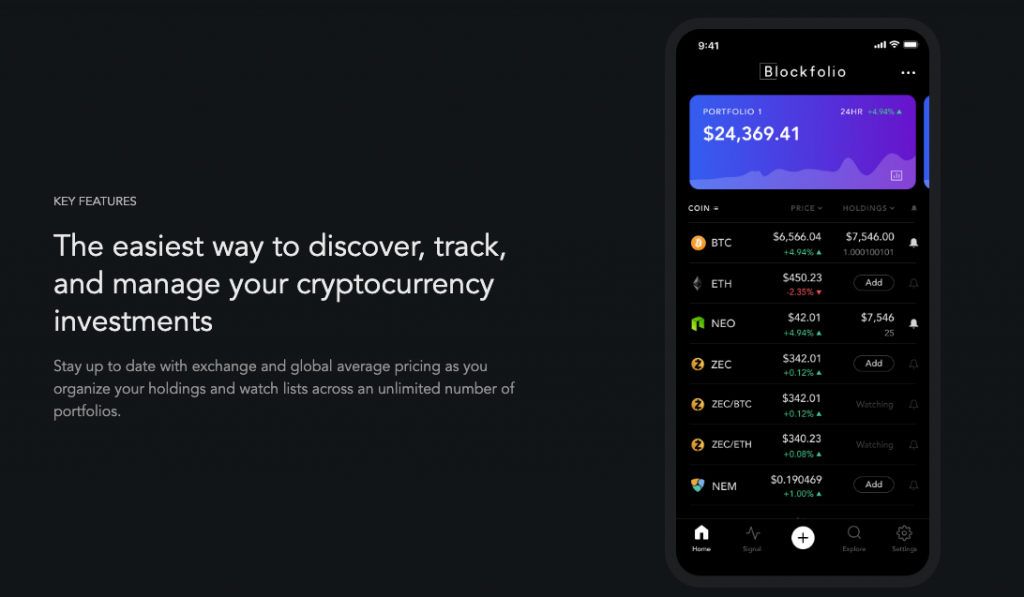

1. Blockfolio

This Los Angeles-based company is among the oldest and most popular cryptocurrency portfolio tracker apps on the market. Founded in 2014, it offers data for over 8,000 different digital assets and allows users to track their crypto portfolio.

Blockfolio is completely free and enables users to receive updates directly from the companies and developers behind the coins in their portfolio. It is a mobile-only app, but it is available both for Android and iOS.

The only downside to Blockfolio is the fact that it’s simple and straightforward UI might lack some of the features professional traders might want to use.

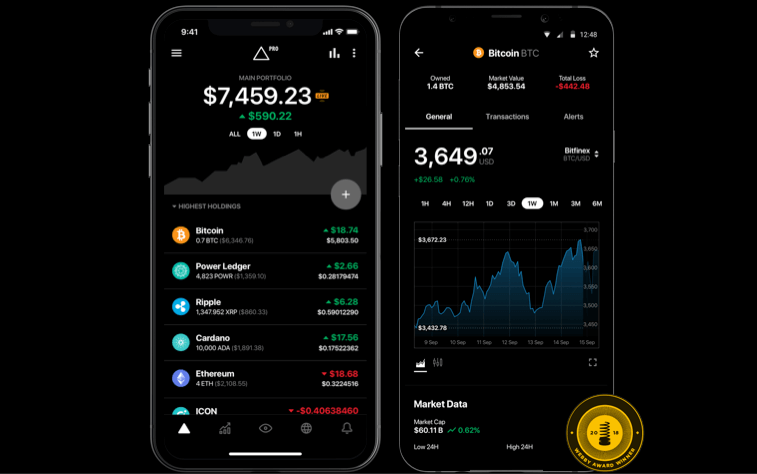

2. Delta

With over a million downloads, Delta is also among the most popular mobile crypto tracking apps. While the app is mostly mobile-oriented, the company offers desktop clients for Windows, Mac, and Linux.

Delta users can set up Watchlists to track the movement of the coins they plan on buying. The app also enables users to connect their exchange accounts and sync their crypto wallets with their Delta accounts.

A feature that sets Delta apart is its Account Recovery option, allowing users to restore the app to its last known state via a recovery code. The low number of exchanges it supports and the relatively high cost of the PRO version ( $60-$70 per year) are the app’s biggest disadvantages.

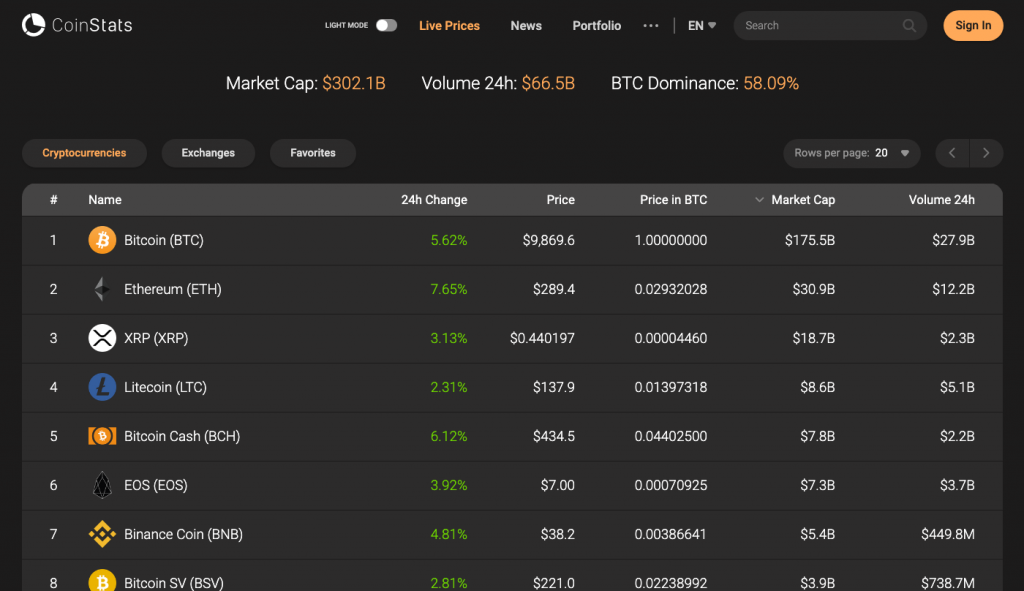

3. CoinStats

Founded in 2017 as an answer to the ever-growing need for an all-in-one price and portfolio tracker, CoinStats is a crypto portfolio tracker app that allows its users to track and manage over 3,000 different cryptocurrencies in a single interface. The app is available on desktop and mobile devices (both Android and iOS) and has more than 500,000 active users.

While the app’s UI and design aren’t revolutionary, its long list of features sets it apart from the competition. CoinStats analyzes crypto prices from over 100 exchanges in order to provide the most accurate data and enables its users to get notifications from dozens of companies behind the coin projects thanks to its Chat feature.

Users can create portfolios by syncing their accounts with 13 different exchanges and 9 crypto wallets.

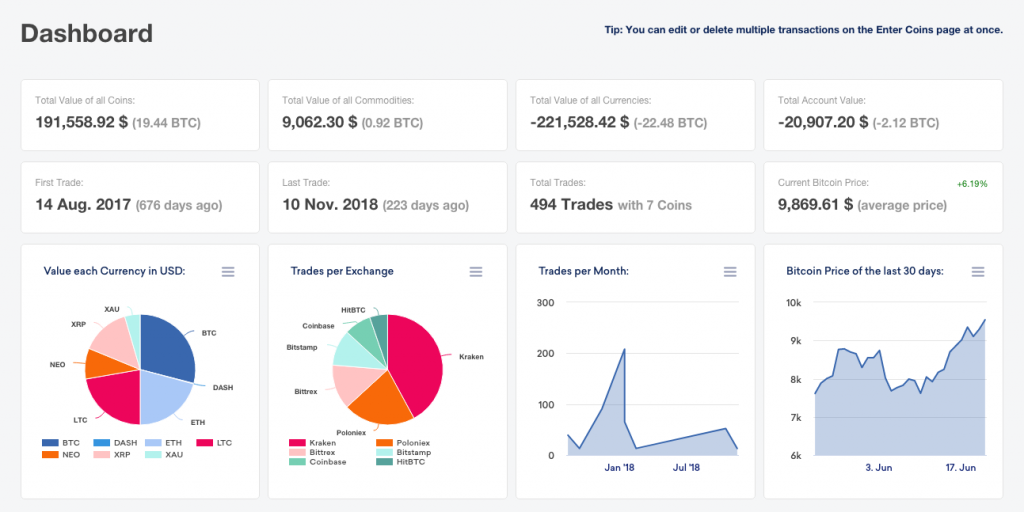

4. CoinTracking

CoinTracking is a portfolio tracking and cryptanalysis tool aimed at more experienced traders. While there is a mobile app available for iOS and Android, the platform is mainly desktop focused.

The app offers a wide range of complex features such as automatic exchange and blockchain imports, tax computation, personal trade backups, personal exports in CSV, XLS, PDF, etc. However, most of these features are only available on the paid plans, which range from $180 to $3,400, depending on the length of the plan.

However, despite the steep prices, CoinTracking will most likely be worth the money for an active trader with a large portfolio. With over 50 exchanges and dozens of software and hardware wallets supported, the app is designed to meet the expectations of even the most demanding traders.

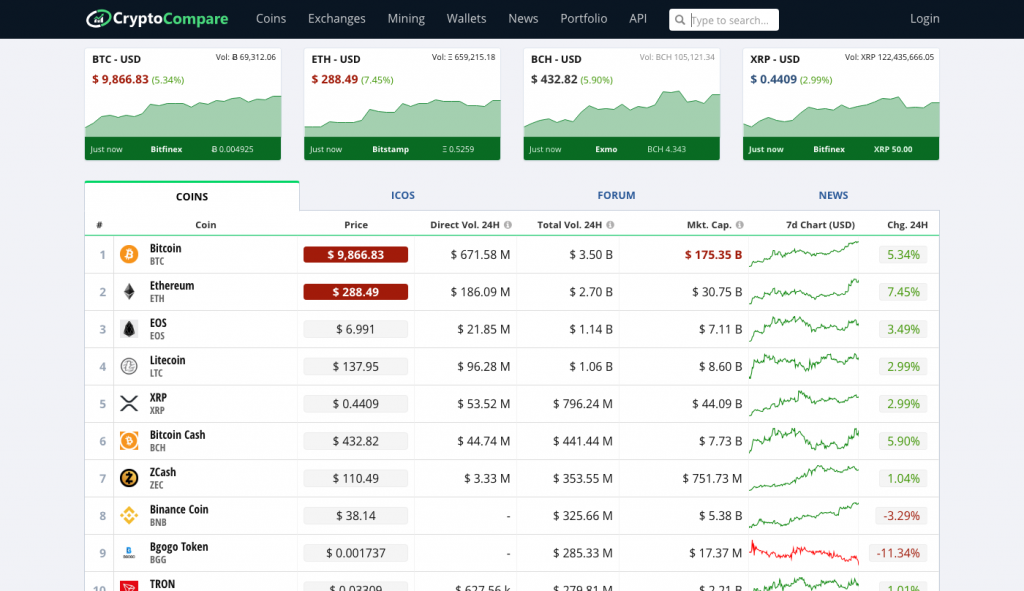

5. CryptoCompare

Envisioned as an ecosystem for everything crypto-related, CryptoCompare offers much more than just price tracking. The desktop focused website has an educational section that allows its users to learn more about different wallets and cryptocurrency mining.

One of the app’s most praised features is its Risk Analyzer, which breaks down users’ holdings and gives insight into how volatile their portfolios are. Detailed and simple to understand documentation is provided for every feature, making CryptoCompare attractive to newer traders.

Unfortunately, all trades have to be added manually as the app has no API sync capability. While infrequent users might not find this problematic, more active traders would need to subscribe to one of the app’s commercial paid plans.

CoinGlass

CoinGlass

Farside Investors

Farside Investors