Step aside Bitcoin: data shows Ethereum is a hedge against global volatility

Step aside Bitcoin: data shows Ethereum is a hedge against global volatility Step aside Bitcoin: data shows Ethereum is a hedge against global volatility

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin bulls have long been pointing to its potential as a “digital gold” as one reason why it will eventually garner widespread adoption. In spite of this, there has been conflicting research regarding this notion, and the potential for other major cryptocurrencies – including Ethereum (ETH) — to be safe-haven assets has often been overlooked.

Now, however, one research group is explaining that Ethereum may provide a notable hedge against intraday volatility seen across multiple markets.

This claim, and the data backing it, may ultimately prove to be another selling point for ETH, adding to the growing list of reasons why the crypto has significant long-term prospects.

Data shows Ethereum is becoming a hedge against volatility in traditional assets

In a recent report from Artem Meshcheryakov and Stoyu Ivanov from San Jose State University, the two researchers take a data-driven approach on analyzing whether or not Ethereum can be categorized as a hedge or safe-haven asset against volatility seen across multiple markets.

The methodology used to reach their conclusions is carefully detailed throughout the report, with data being pulled from five-minute pricing intervals between Dec. 12, 2017, and Dec. 31, 2018.

In conclusion, by comparing a variety of details surrounding Ethereum’s price action to that of the US stock market, gold, and the US Dollar, they found that the cryptocurrency is quickly becoming a hedge, safe haven, and diversifier across these markets.

“We find that Ethereum…can serve as an intraday hedge against the US stock market and against the gold. Also, Ethereum may serve as an intraday safe haven against gold markets. When currency markets are concerned, we document that Ethereum tend to act as a diversifier on intraday basis for the US Dollar.”

ETH’s long-term outlook continues growing bullish

The above conclusion is certainly bullish for Ethereum, as it now appears that its growing status as a hedge against global economic turmoil could bolster its attractiveness to investors.

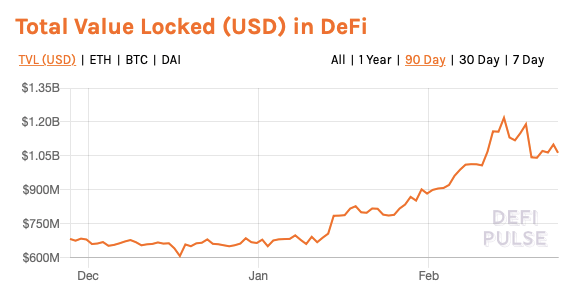

Another key factor that has been counting in ETH’s favor as of late is the growing DeFi trend, which has resulted in a significant amount of Ethereum being locked within collateralized loans.

Currently, the total USD value of ETH locked within DeFi is over $1 billion, and it is showing no signs of slowing down anytime soon.

The confluence of strong development growth, bullish price action, DeFi’s rising popularity, and its potential status as a safe haven asset is likely to offer Ethereum significant long-term upside.

Ethereum Market Data

At the time of press 12:14 pm UTC on Feb. 25, 2020, Ethereum is ranked #2 by market cap and the price is down 2.69% over the past 24 hours. Ethereum has a market capitalization of $28.83 billion with a 24-hour trading volume of $22.03 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 12:14 pm UTC on Feb. 25, 2020, the total crypto market is valued at at $277.64 billion with a 24-hour volume of $157.95 billion. Bitcoin dominance is currently at 63.16%. Learn more about the crypto market ›