Bitcoin open interest nears YTD high as Binance, BitMEX see significant surge in allocation

Bitcoin open interest nears YTD high as Binance, BitMEX see significant surge in allocation Quick Take

Bitcoin open interest (OI) is on the cusp of reaching new Year-To-Date (YTD) highs, rallying on four key exchanges.

The current OI allocation stands at 464,000 BTC, nearing the YTD peak of 474,000 Bitcoin recorded in January. Binance, with an OI nearing the level seen during the FTX collapse, has 161,000 BTC allocated and a $600 million increase in the past 24 hours.

BitMEX is witnessing its highest Bitcoin OI yet, at 28,500 BTC. OKX and CME both displayed significant growth, with OKX’s OI spiking from 53,000 to roughly 60,000 BTC and CME’s OI growing by 10,000 BTC, from 73,000 to 83,000 BTC.

Accompanying this upward trend is a marked increase in both cash and crypto margin futures open interest.

Cash refers to the total amount of futures contracts OI that is margined in USD or USD-pegged stablecoins, while crypto margin represents futures contracts OI that is margined in the native coin (e.g., Bitcoin) rather than in USD or a stablecoin.

Currently, the percentage of crypto margin futures open interest stands at an impressive 27%, a level not seen since June when Bitcoin was valued at 25,000.

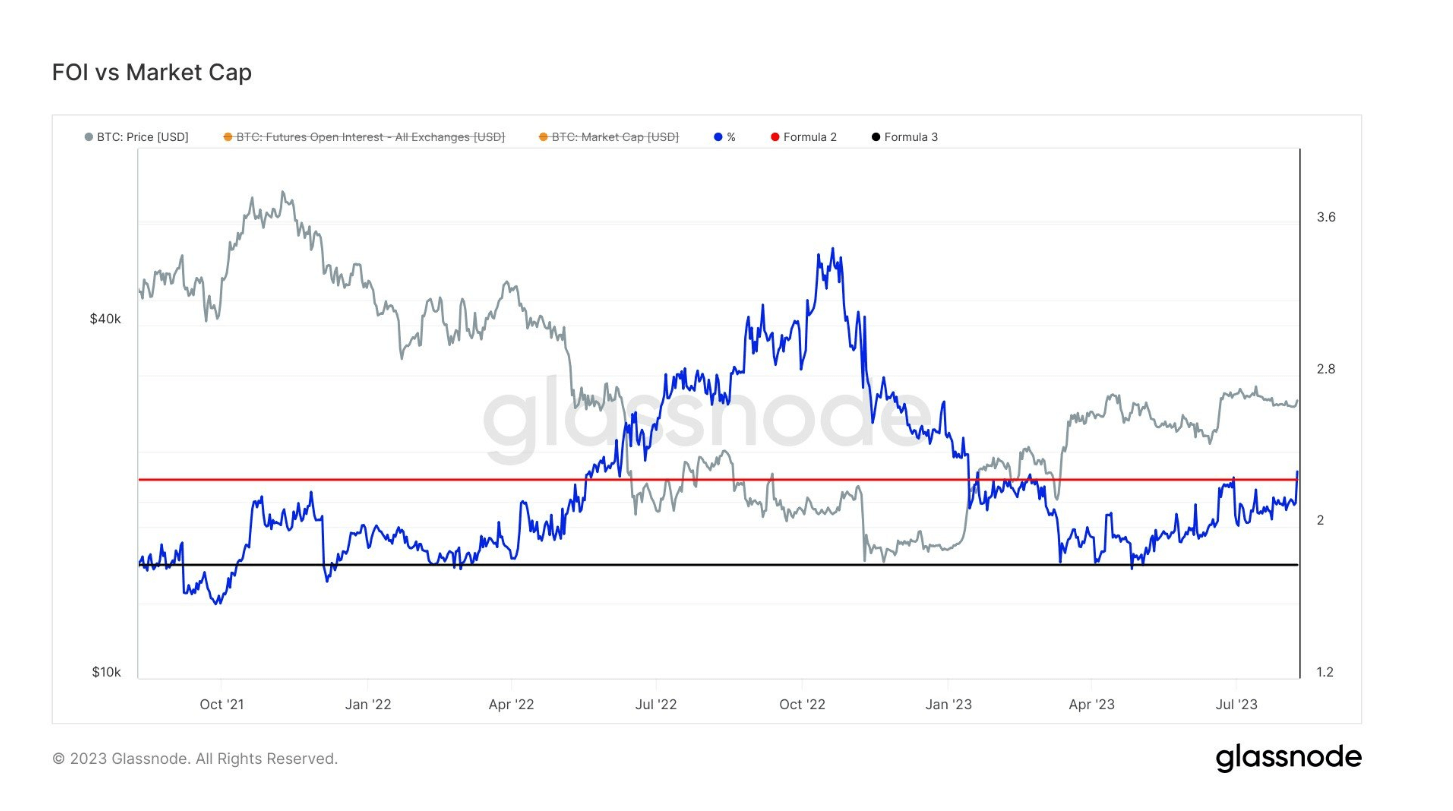

Bitcoin open interest is now greater than 2.25% of the market cap, which is also approaching YTD highs.

Farside Investors

Farside Investors

CoinGlass

CoinGlass