Bitcoin surges above $69k after better-than-expected US CPI

Bitcoin surges above $69k after better-than-expected US CPI Bitcoin surges above $69k after better-than-expected US CPI

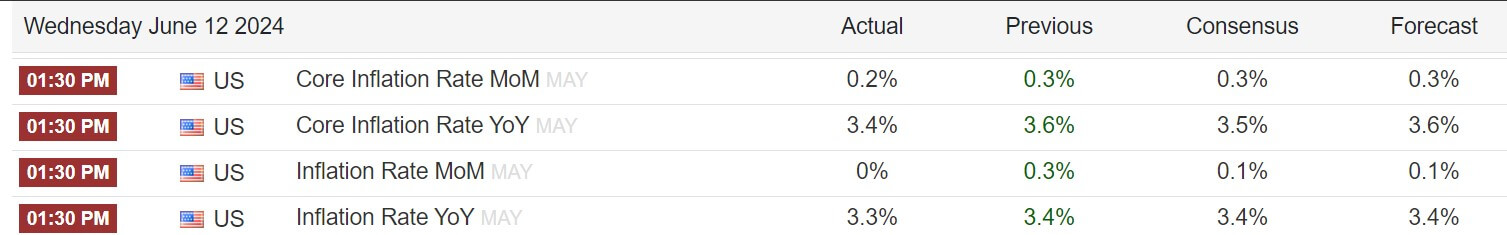

Experts said the current reading show that the core inflation has dropped to its lowest since April 2021.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin’s price has soared past $69,000 after the latest US Consumer Price Index (CPI) for May showed a slight decline.

Available data shows that the much-anticipated US CPI inflation data was better than several experts’ predictions.

Charlie Bilello, the Chief Market Strategist at Creative Planning, said:

“Overall, US CPI moved down to 3.27% year-on-year in May from 3.36% in April. US inflation has now been above 3% for 38 straight months. US Core CPI (ex-Food/Energy) moved down to 3.41% year-on-year from 3.62% last month. This is the lowest core inflation reading since April 2021.”

Bilello further pointed out that the US Inflation rate has drastically reduced from the 9.1% peak of June 2022 to 3.3% today. He added that the decline in these numbers was caused by the “lower rates of inflation in used cars, gas utilities, apparel, food at home, gasoline, medical care, fuel oil, food away from home, shelter, and electricity.”

Bitcoin rises on optimistic CPI

The better-than-expected CPI numbers immediately had a positive impact on Bitcoin’s price, with the BTC rising by more than 2% on the 1-hour candle to as high as $69,377 as of press time.

Mike Alfred, a board member at IREN Energy, pointed out that the movement showed that:

“Bitcoin already knows that CPI + Fed won’t be major bearish catalysts. It’s a highly intelligent global macro asset that prices in almost everything in advance.”

Meanwhile, the market attention has shifted to the US Federal Reserve, which will reveal its decision on current interest rates later today. Jesse Cohen, a Global Markets Analyst at Investing.com, said:

“The May CPI Inflation report could give the Fed the confidence to begin laying out the carpet for rate hikes in the months ahead. It’s going to take a minimum of three or four soft inflation prints before I think they’re ready to cut rates, but this would be a start.”

CryptoQuant

CryptoQuant