Bitcoin ETFs see $380 net inflow in 2 days with BlackRock leading the charge

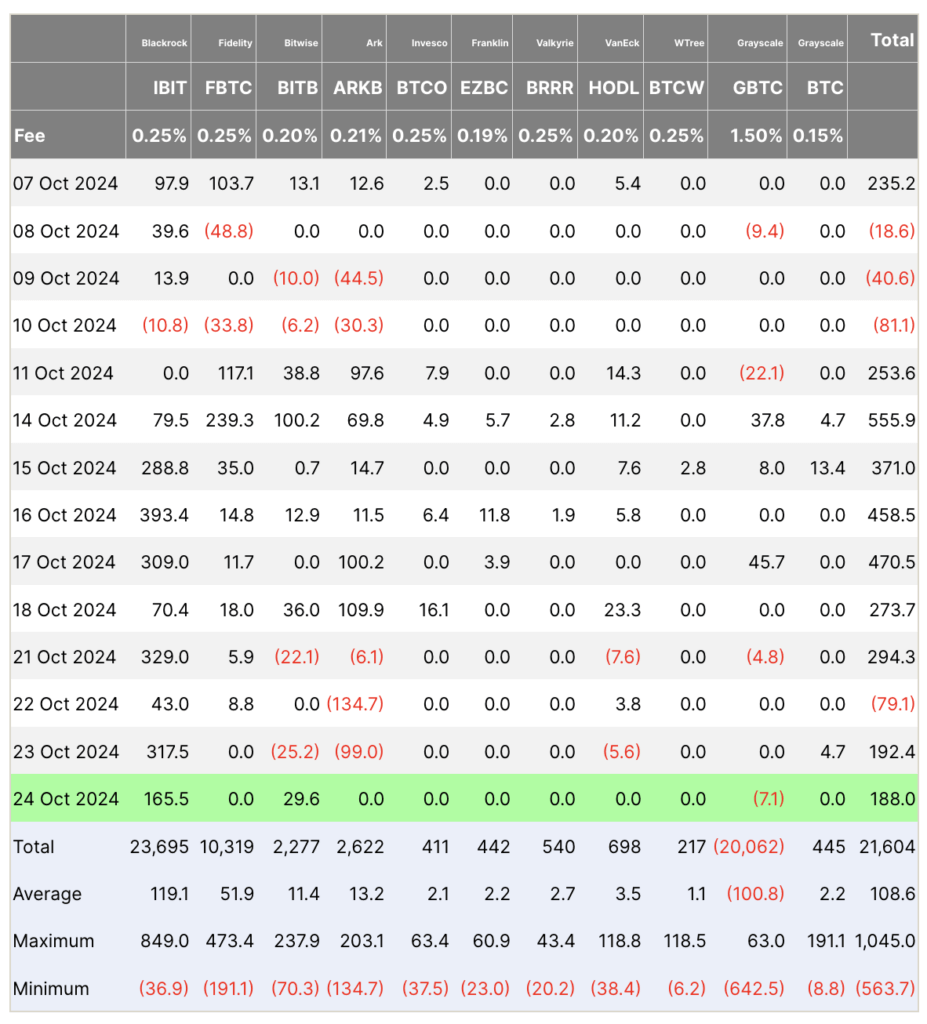

Bitcoin ETFs see $380 net inflow in 2 days with BlackRock leading the charge Bitcoin exchange-traded funds (ETFs) showed mixed activity over the past two days, following a net outflow of $79.1 million on Oct. 22 that ended a seven-day inflow streak totaling over $2.4 billion since Oct. 14.

On Oct. 23, ETFs registered a net inflow of $192.4 million. The iShares Bitcoin Trust (IBIT) led with $317.5 million in new investments, while ARK’s Bitcoin ETF (ARKB) saw significant outflows of $99 million. Bitwise’s BITB also recorded an outflow of $25.2 million.

The following day, Oct. 24, ETFs continued to attract capital with a net inflow of $188 million. IBIT maintained its strong performance, bringing in an additional $165.5 million. Bitwise’s BITB reversed its previous day’s outflow by gaining $29.6 million. However, Grayscale’s BTC fund experienced a minor outflow of $7.1 million.

The sustained inflows into IBIT highlight its prominent role in offering traditional investment exposure to Bitcoin. President of the ETF Store, Nate Geraci, pointed out BlackRock’s performance on Oct. 24 alone “would easily put IBIT in top 10% of all launches in 2024 (out of 575+ ETFs).” Conversely, the outflows from ARKB suggest possible profit-taking or shifts in investment strategies.