Bankrupt Celsius stake $57M worth of Ethereum: Arkham

Bankrupt Celsius stake $57M worth of Ethereum: Arkham Bankrupt Celsius stake $57M worth of Ethereum: Arkham

On-chain sleuth Lookonchain reported that the bankrupt lender Celsius had withdrawn over 6000 ETH in April.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bankrupt crypto lender Celsius has resumed staking Ethereum (ETH), according to data shared by Arkham Intelligence.

Arkham reported that the bankrupt lender staked 30,800 ETH — $56.9 million — via staking solutions provider Figment during the past week. A research analyst at 21Co, Tom Wan, corroborated the Arkham report.

According to Wan, Celsius deposited over 40,000 Ethereum through Figment between May 10 and May 12.

The reason behind this deposit is currently unknown, considering Celsius withdrew part of its staked ETH in April. At the time, industry players interpreted this as a move that the bankrupt firm was consolidating its assets.

Celsius remains one of the biggest firms with a staked ETH portfolio. According to the Arkham Intelligence dashboard, the lender holds 410,378 staked ETH worth $749.37 million.

Meanwhile, Celsius transactions are not altogether surprising given that several entities that withdrew their staked ETH have begun re-staking them. Liquid staking derivatives protocol Lido has led the charts in staked ETH withdrawals and deposits over the past few weeks, according to Nansen’s dashboard.

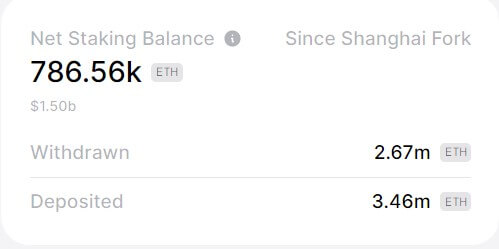

Total ETH staking deposits soar above withdrawals.

The total number of staked ETH reached a new all-time high of 21.62 million worth $39.5 billion — as staking deposits have surpassed withdrawals — according to Etherscan data.

Since withdrawals were enabled on April 12, the total number of ETH withdrawn stands at 2.67 million, while ETH deposited is at 3.46 million. This means there is a net staking balance of 785,000 ETH, according to Token Unlocks data.

Nansen’s data corroborates the above. According to its dashboard, several crypto entities like Kraken and other centralized exchanges led the initial wave of withdrawals in compliance with the regulatory pressure they faced from U.S. financial regulators.

However, as these entities’ withdrawals began to subside, liquid staking protocols like Frax Ether and Rocket Pool have seen the total value of assets locked on their platforms increase by double digits within the past month, according to DeFillama data.