Pantera Capital Believes The Worst Is Over For Bitcoin

Pantera Capital Believes The Worst Is Over For Bitcoin Pantera Capital Believes The Worst Is Over For Bitcoin

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

It’s no secret that cryptocurrencies are significantly less enthralling than they were just four months ago. They are growing in usability and adoption, but their prices are relatively stagnant – especially compared to last year. 2017 was a glamouring campaign, but 2018 is a more muted growth period.

At the time, few realized that an unexpected market drop just before Christmas would signal the beginning of the end for the nearly 12-month digital currency bull run that shook markets and transformed spurious observers into enthralled participants.

Since every crypto skeptic was enthusiastically looking for a bubble, this felt like the moment that crypto markets would suddenly diminish and ultimately dissolve.

Of course, that never came to fruition. Markets would recover from their December lull to reach all-time highs before dropping once again in January.

No Bubble. Just Boring.

However, no bubbles popped. Instead, something far more surprising happened. Crypto markets slouched into an interminable holding pattern in which prices fluctuated considerably less than the previous year, and interest in digital currencies significantly decreased.

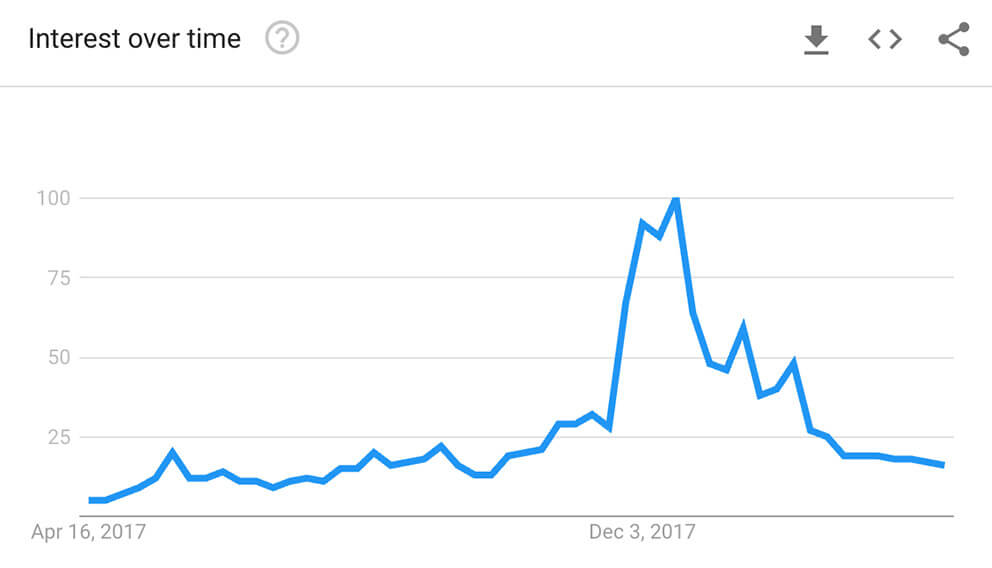

While Bitcoin once ruled the search realm, Google Trends reveals that searches for Google are down 84% from their peak in mid-December. Moreover, the Wall Street Journal reports that Bitcoin trading volume is down 70% in April.

With a current collective cap of more than $300 billion, it’s challenging to say that cryptocurrencies are slumping. They are just enduring a lull. In other words, as the Journal contends, they’ve entered a boring phase.

Fortunately, if industry experts are correct, that phase could be ending soon.

The Worst is Over

In his April newsletter published this week on Medium, distinguished crypto hedge fund, Pantera Capital CEO, Dan Morehead, expressed optimism that Bitcoin’s worst days are behind it.

The update covered several hot topics surrounding cryptocurrencies. For instance, Morehead speculates that some of the market’s movement is attributable to tax season, and the need for crypto investors to pay taxes on their extraordinary capital gains from 2017.

What’s more, Morehead expresses support for the SEC’s actions targeting fraudulent ICOs. In addition, he surmises that markets have reached “peak negativity” when it comes to ICOs, so he expects that markets have reacted as strongly as they are going to for the foreseeable future.

Most importantly, Morehead is extremely bullish on the long position for digital currency markets. Specifically, Morehead predicts that Bitcoin will exceed $20,000 in 2018. His optimism is unbridled. He writes,

“I rarely have such strong conviction on timing. A wall of institutional money will drive markets much higher.”

He’s not expressing blind optimism. First, Morehead is betting that our herd mentality is driving prices down. People tend to follow the crowd, so, in this case, they are selling digital currencies to avoid being isolated in a money-losing endeavor.

He uses historical data that convincingly predicts that Bitcoin is likely to break out of its slump soon. Since Bitcoin just passed its 200-day moving average, Morehead contends, it’s ready to make a significant price jump.

Indeed, Morehead’s predictions are slowly playing out in the markets. Institutional money is entering the conversation, and markets have enjoyed a rare streak of near-unanimous price gains this week. The metrics look good, and now we will look to see if the money will follow.