Data shows over 100 million unique users now have Bitcoin and crypto accounts

Data shows over 100 million unique users now have Bitcoin and crypto accounts Data shows over 100 million unique users now have Bitcoin and crypto accounts

Photo by André François McKenzie on Unsplash

A new report commissioned by the Cambridge Center of Alternative Finance, a research effort focused on cryptocurrencies, said over 101 unique million users opened new accounts at crypto service providers such as exchanges and wallets.

The metric showed strong growth for the nascent industry, which has been positioned as an alternative to gold and government bonds in recent times as a store of value to combat a bleak economic outlook and global slowdown.

Report from Cambridge Centre for Alternative Finance highlights greater regulatory compliance by cryptoasset service providers. https://t.co/Ti0h9k3Tu0 pic.twitter.com/OICEuKKYfC

— CJBS Exec Ed (@CambridgeExecEd) September 26, 2020

Cambridge said the sample was sourced from 175 service providers, 75 mining companies, and 30 individual miners, and was collected between March and May 2020.

100 Million turn to Bitcoin and crypto

The report said over 101 million unique users opened an estimated 191 million accounts opened as of Q3 of 2020, as per data provided by the various crypto businesses. The growth was thrice that of the whole of 2018 when the number of identity-verified users was only 35 million globally.

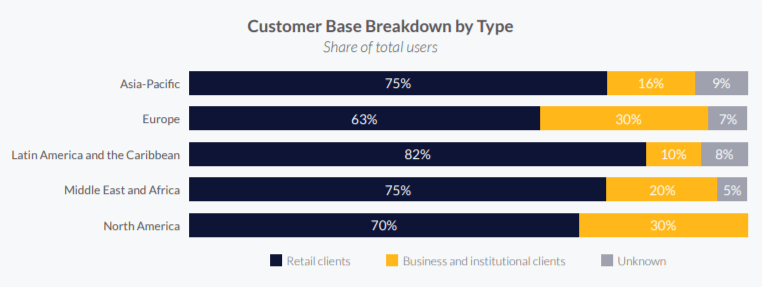

North American, Middle Eastern, and African companies appear to have a more geographically diversified clientele, with service providers in both regions reporting that 42% of their customers were from other regions — such as European firms registering users from Middle East Asia.

Service providers operationally headquartered in North America and Europe indicate that business and institutional clients make up 30% of their customers. However, this figure was much lower for APAC and Latin American firms at 16% and 10% respectively, the report said.

The composition of business and institutional clientele differed from region to region. While North American and European firms were seen to primarily served cryptoasset hedge funds and traditional institutional investors, Middle Eastern and African service providers that cater to non-retail clients focus on online merchants (50%).

Crypto industry sees slowed employment

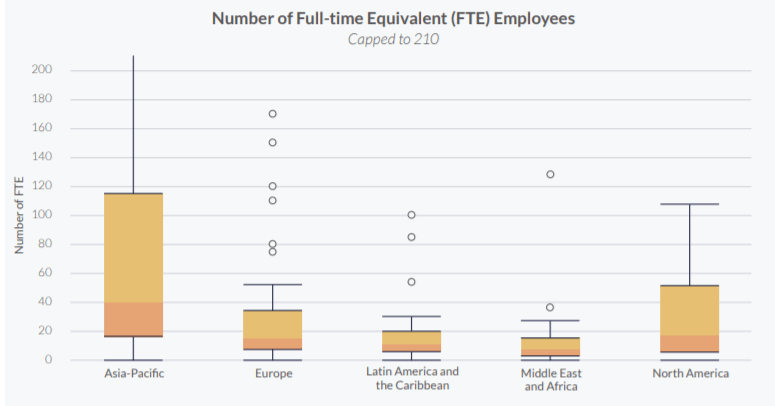

Full-time equivalent (FTE) employee growth slowed considerably following the late-2017 market frenzy, the report said.

Respondents across all market segments, reported year-on-year growth of 21% in 2019, down from 57% in 2018.

Industry-wide, the growth in FTE employment declined by 36 percentage points between 2017 and 2019, whereas the median firm reported a 75-percentage point downward change in employment growth.

The difference in the industry-level and the firm-level employment growth figures reflected the rise of large firms within each industry group that dominated the aggregate change in employment and suggested that a few large players are dominating the industry.

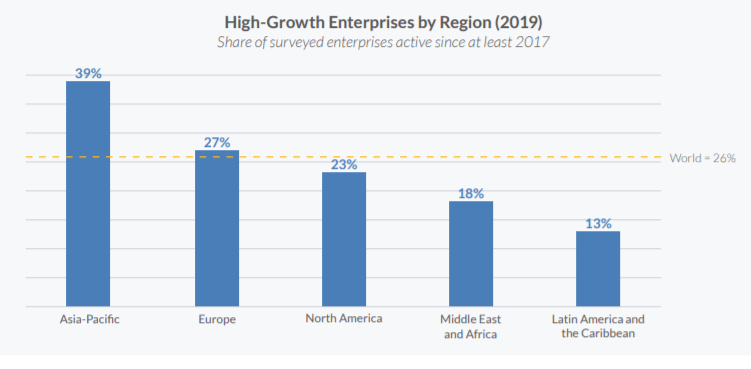

However, not all firms were equal: individual firm employment data showed that a notable proportion of companies (26%) have sustained an annualized growth in employment level above 10% over the past three years.