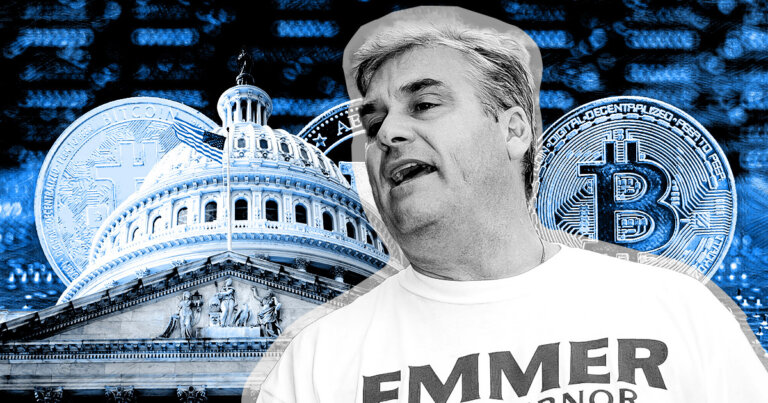

Congressman Emmer introduces bill providing ‘safe harbor’ to miners, developers and wallets

Congressman Emmer introduces bill providing ‘safe harbor’ to miners, developers and wallets Congressman Emmer introduces bill providing ‘safe harbor’ to miners, developers and wallets

Under Emmer's bill, entities that do not custody or control consumer funds should be exempt from stringent regulations.

Jonathunder / CC BY-SA 3.0 / Wikimedia. Remixed by CryptoSlate

Congressman Tom Emmer and Darren Soto introduced a bipartisan bill on March 23 called the Blockchain Regulatory Certainty Act to establish more clarity for the crypto industry.

Emmer serves as co-chair of the Congressional Blockchain Caucus alongside Soto. He said in the announcement:

“Crypto and blockchain technology, by nature, does not easily fit into the frameworks policymakers have considered when crafting regulations in the past. For too long, federal regulators and lawmakers have jammed the blockchain ecosystem into statutory definitions that just do not make sense.”

‘Safe Harbor’ for non-controlling entities

Under Emmer’s bill, only entities that custody consumer funds should be considered money transmitters. According to Emmer:

“It should be simple: If you don’t custody consumer funds, you aren’t a money transmitter. “

As such, miners, validators and crypto wallet software providers should not have to apply for licensing or be subject to regulatory requirements as they do not have direct custody of consumers’ crypto.

The bill proposes giving blockchain developers, miners, validators and non-custodial wallet software providers legal “safe harbor” from stringent regulations placed on entities that do control consumer funds, like exchanges.

Blockchain Regulatory Certainty Act

Based on the Congressional record, the bill was first introduced in 2018.

Its main aim is to establish that certain blockchain developers and certain blockchain service providers should be exempt from stringent licensing and regulatory reporting requirements that are placed on money transmitters.

It previously failed to gain traction in the house in previous years due to the lack of interest following the 2017 market crash.

However, political interest in the blockchain space has seen a massive resurgence since; and with the end of the bear market on the horizon, politicians and regulators are scrambling to establish rules.